Navigating the world of startup funding can be complex. This guide breaks down the key stages, from pre-seed to IPO, outlining the investment landscape, preparation essentials, and strategies for success at each step.

Securing funding is vital for any startup’s success. This comprehensive guide demystifies the various stages of startup funding, empowering entrepreneurs to make informed decisions and fuel their venture’s growth.

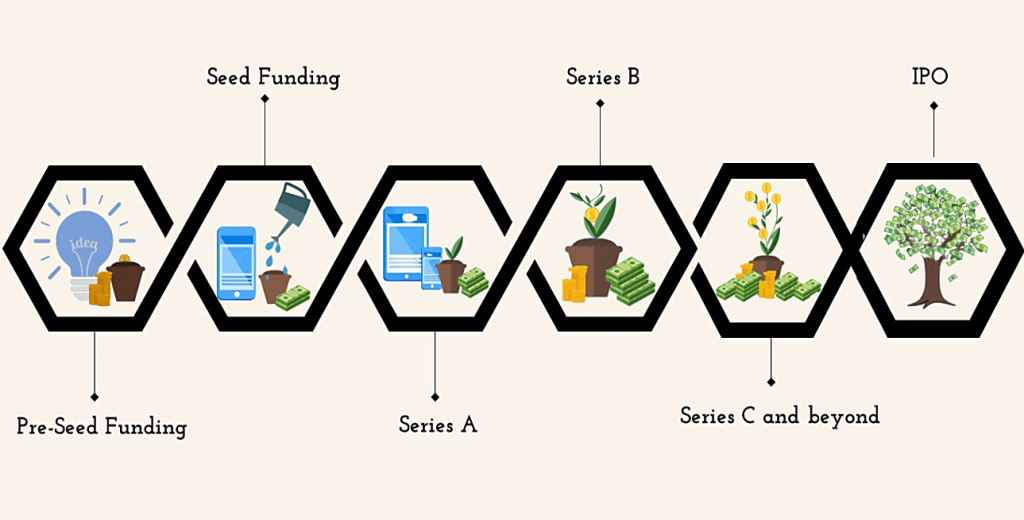

The Funding Journey:

The journey typically starts with pre-seed funding, where founders utilize personal resources to develop their idea and create a minimum viable product (MVP). This stage focuses on validating the concept and attracting further investment.

Seed funding follows, marking the first official equity funding round. Startups use these funds to refine their product, go-to-market strategy, and build traction.

As the startup gains momentum, Series A financing becomes crucial for scaling operations, expanding the market, and building a substantial user base.

Series B funding focuses on solidifying market dominance and accelerating growth. Established startups use these funds to expand geographically, enhance their product offerings, and invest in marketing and sales.

Series C and beyond, while optional, provide a final push before a potential IPO or help achieve goals unmet in earlier stages.

The Initial Public Offering (IPO) marks a significant milestone where the company offers shares to the public, raising capital and providing an exit opportunity for early investors.

Navigating the Investor Landscape:

Understanding the different types of investors is crucial:

- Friends and family: Offer initial support but require careful handling to preserve personal relationships.

- Angel investors: Provide capital, mentorship, and valuable industry connections in exchange for equity.

- Venture capital firms: Invest in high-growth startups, offering expertise, networks, and significant funding.

- Crowdfunding platforms: Allow startups to raise funds from a large pool of individual contributors.

Preparation is Key:

Before approaching investors, startups must have a robust business plan outlining their vision, target market, and financial projections.

A comprehensive financial model is essential to demonstrate financial viability and potential returns for investors.

A compelling pitch presentation should succinctly communicate the startup’s value proposition, market opportunity, and team’s capabilities.

Understanding the due diligence process, where investors thoroughly evaluate the startup’s financials, legal standing, and operations, is vital for a smooth funding process.

Conclusion:

Securing startup funding is a journey requiring careful planning, preparation, and a deep understanding of the funding landscape. By embracing these principles, startups can increase their chances of success and achieve sustainable growth.

Frequently Asked Questions

What are the 4 rounds of funding?

The four main stages of venture capital funding are Pre-Seed, Seed, Series A, and Series B rounds. Each stage offers a different form of investment to help businesses grow and reach their goals.

Ultimately, it is essential for startups to understand these rounds in order to secure the right funding for their venture.

What are the four stages of start up financing?

The four stages of startup financing include seed funding, early-stage equity rounds, late-stage equity rounds, and public offerings or financial sponsor-backed exits. Each stage provides companies with much needed capital to help scale their business and achieve their goals.

With the right guidance and support, startups can secure the capital they need to grow into new markets.

What are the different stages of startup?

The six stages of a startup are ideation, validation, engineering, product development, scaling, and growth. Each stage is unique and requires specific strategies and tactics in order to achieve success.

Understanding the different stages of a startup will enable you to create a roadmap for your journey to success.

How many stages are there in funding?

There are six distinct stages of startup funding that businesses can access, ranging from pre-seed and seed funding stage to venture capital and grant funding. This gives business owners a range of options to help get their business up and running.

With the right strategy and resources, it is possible to secure the necessary funds to start or grow a business.