Congratulations on embarking on this thrilling journey of building something impactful! Picking up this guide suggests you’re deeply immersed in crafting your minimum viable product and testing its potential in the market – that’s fantastic!

This guide is designed to be your trusted companion as you navigate the world of Simple Agreements for Future Equity (SAFEs). We’ll demystify the intricacies of SAFEs, equipping you with the knowledge and confidence to negotiate with investors effectively. By the time you finish reading, you’ll have a solid understanding of this essential fundraising tool.

Decoding the Simple Agreement for Future Equity (SAFE)

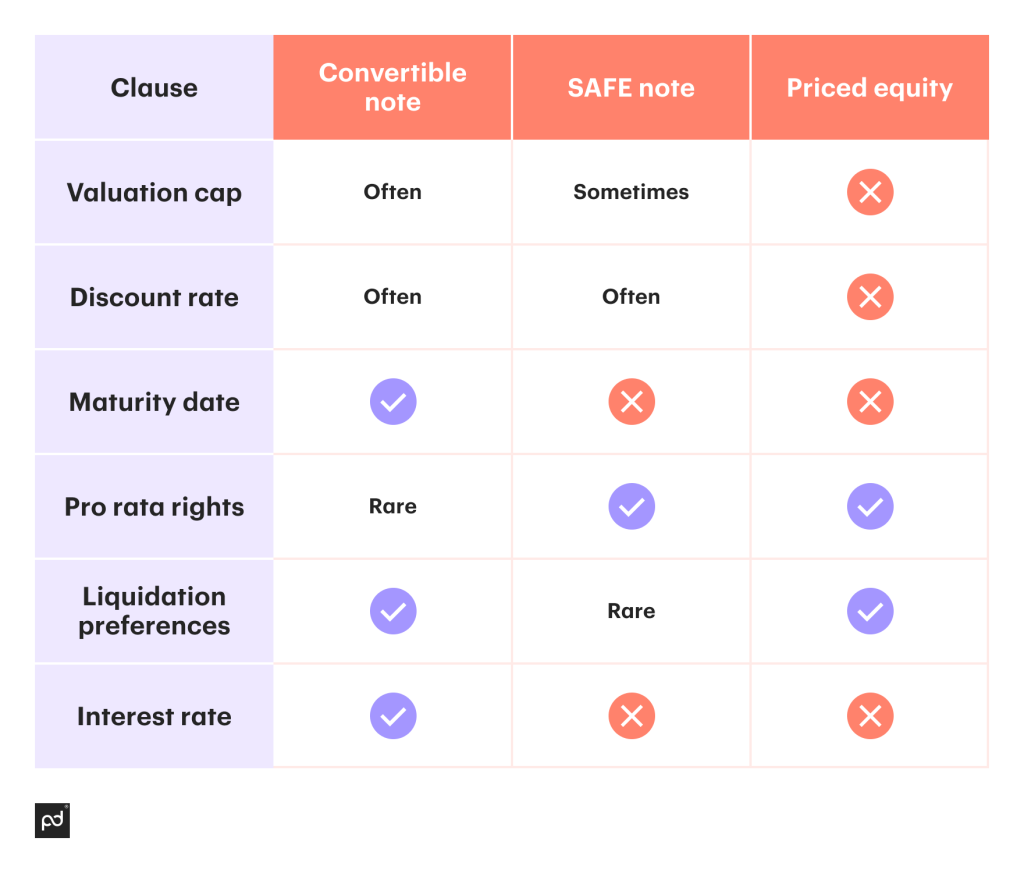

A Simple Agreement for Future Equity (SAFE) is a straightforward contract used by startups and investors to streamline early-stage fundraising. Essentially, it grants investors the right to purchase shares in the company during a future priced funding round in exchange for their investment. Unlike traditional convertible notes, SAFEs are not debt instruments; they don’t accrue interest or have a fixed maturity date.

Pioneered by Y Combinator in 2013, SAFEs gained rapid adoption for their simplicity and founder-friendliness. Initially designed as “pre-money” agreements, the landscape evolved with larger funding rounds. This led to the introduction of the “post-money” SAFE in 2018, which has since become the industry standard.

The key difference lies in how ownership is calculated. Post-money SAFEs clearly define investor ownership percentages after accounting for all SAFE investments but before the next priced funding round, usually a Series A. This transparency is crucial for managing equity and dilution as the company grows.

Today, Y Combinator offers four main SAFE variations, each with its own set of terms:

SAFE: Valuation Cap, No Discount

SAFE: Discount, No Valuation Cap

SAFE: Valuation Cap and Discount (While removed from Y Combinator’s website, it remains in use).

SAFE: MFN, No Valuation Cap, No Discount

While these templates offer a starting point, investors and founders often tailor specific terms with legal guidance to best suit their individual needs.

Why Startups Love SAFEs

The startup community has enthusiastically embraced SAFEs for a number of reasons:

Speed and Simplicity:

SAFEs are remarkably concise and easy to understand, typically around six pages long. This simplicity translates to faster negotiations and a more streamlined, cost-effective investment process.

Founder-Friendly Terms:

Unlike convertible notes, SAFEs do not burden founders with interest payments, maturity dates, or the obligation to repay the principal if the company doesn’t reach a qualifying funding round. This allows founders to focus on building their businesses without the pressure of looming deadlines or debt repayment.

Flexibility in Fundraising:

SAFEs empower startups to raise capital incrementally. They can close deals with investors as soon as both parties are ready, allowing for a more flexible and efficient fundraising process, often referred to as “high-resolution fundraising.”

Focus on Growth:

By eliminating the complexities of traditional financing instruments, SAFEs free up valuable time and resources, allowing founders to concentrate on what matters most: building a successful company.

While SAFEs offer significant benefits to startups, it’s important to remember that they are not suitable for all investors. Investors seeking a guaranteed return or those uncomfortable with the risks inherent in early-stage investing may prefer alternative investment structures.

The Potential Downsides of SAFEs

While SAFEs offer significant advantages, it’s important to be aware of their potential drawbacks:

Absence of Equity Stakes:

It’s crucial to understand that SAFE investors don’t immediately receive equity in the company. They’re essentially holding a promise of future equity contingent upon specific events, like a qualified fundraising round. This lack of immediate equity means SAFE investors have limited rights and protections compared to traditional shareholders. If those triggering events never materialize, investors risk walking away empty-handed.

The Simplicity Trap:

The very simplicity that makes SAFEs attractive can also pose a risk. The ease of raising funds through SAFEs can sometimes lead founders to raise more capital than strategically necessary, without fully grasping the long-term implications for equity dilution. When the SAFEs eventually convert, founders may find themselves with a significantly smaller ownership stake than anticipated.

Careful planning, a solid understanding of future equity implications, and seeking legal counsel are essential to navigate these potential disadvantages effectively.

How SAFEs Convert into Equity

Decoding the SAFE Discount

Early-stage investments come with inherent risks, and the SAFE’s discount mechanism is designed to compensate investors for taking that leap of faith.

In simple terms, the discount grants SAFE investors the right to purchase shares in the future priced round at a lower price than new investors. The discount typically ranges from 5% to 30%, with 20% being the most common.

Here’s an example:

Imagine a SAFE with a 20% discount. If new investors purchase shares at $1 per share during a Series A round, SAFE investors would pay only $0.80 per share upon conversion. A higher discount translates to more equity for the SAFE investor.

Important Note:

The SAFE agreement clearly states the discount rate as a percentage less than 100%. So, you’ll see a 20% discount represented as “80%,” and a 10% discount as “90%.”

Beyond the Discount: The Valuation Cap

While the discount offers some protection, it might not be sufficient for rapidly growing companies. In such scenarios, investors often utilize a valuation cap alongside the discount to ensure their investment keeps pace with the company’s increasing value. We’ll explore the concept of the valuation cap in detail next.

Navigating Valuation Caps in SAFEs

The valuation cap is often the most heavily negotiated term in a SAFE agreement. Why? Because it sets the maximum price a SAFE investor will pay for their shares, regardless of the company’s actual valuation in a future priced round.

Understanding the Mechanics

Let’s say a SAFE has a valuation cap of $10 million. If the company later raises a Series A at a $20 million valuation, SAFE investors will essentially purchase shares at half the price of the new investors, giving them a significant advantage.

The SAFE agreement provides a formula to calculate the price per share (referred to as the “safe price”) using the valuation cap:Safe Price = Valuation Cap / Company Capitalization

Importantly, the company capitalization includes not just existing shares but also all convertible securities like other SAFEs, convertible notes, and options.

Balancing Rewards and Dilution

Setting the right valuation cap is a delicate balancing act. While rewarding early investors for their risk is essential, founders must also protect themselves from excessive dilution. A low valuation cap can disproportionately favor SAFE investors, leaving founders with a significantly smaller ownership stake down the line.

Strategic Considerations for Founders

Don’t Confuse a Cap with a Valuation: A valuation cap is not a true reflection of the company’s current worth; it’s simply a ceiling on the price SAFE investors will pay in the future.

Project Realistically: Determine a valuation cap that reflects a reasonable projection of the company’s value at its next fundraising stage.

Consider Alternatives: If possible, try to negotiate SAFEs with a discount but no valuation cap. This rewards early investors without setting an artificial ceiling on the company’s future value.

Ultimately, finding the right balance between attracting early-stage investment and maintaining reasonable equity for founders is crucial.

Understanding Valuation Cap Scenarios: How SAFEs Convert

When a SAFE includes a valuation cap, there are three potential outcomes during conversion at a priced funding round:

Scenario 1: Valuation Cap Exceeds Priced Round Valuation

This scenario suggests the company raised a priced round at a valuation lower than the SAFE’s cap, which isn’t ideal for demonstrating growth. However, it simplifies the SAFE conversion. Investors either convert at the discount rate (if applicable) or at the same price as new investors if there’s no discount.

Scenario 2: Valuation Cap is Lower than Priced Round Valuation

This is the most common—and generally desirable—outcome. The company has secured a higher valuation in the priced round, signaling positive growth. SAFE investors benefit from their early investment by converting at the lower valuation cap, unless a discount rate results in an even more favorable price.

Scenario 3: Valuation Cap Matches Priced Round Valuation

In this scenario, the priced round valuation precisely matches the SAFE’s cap. SAFE investors convert at the same price as new investors, effectively nullifying any price advantage from the cap. If a discount is present, they’ll convert at the discounted price, as that would be more beneficial than the matching valuation.

Understanding Most Favored Nation (MFN) Clauses in SAFEs

An MFN clause in a SAFE provides early investors with a valuable safeguard—the right to match the most favorable terms offered to future SAFE investors. In essence, it ensures that early supporters aren’t disadvantaged if later investors strike a better deal.

How MFNs Work

Imagine an investor contributes $20,000 under an MFN-only SAFE (no cap or discount). Later, a new investor invests $2 million with a capped and discounted SAFE. The company must inform the initial investor about these new terms. If the first investor finds the later terms more advantageous, they can choose to amend their original SAFE to match.

Benefits and Drawbacks of MFNs

MFNs offer benefits like:

Investor Protection: They provide peace of mind to early investors, knowing their terms won’t be less favorable than those offered later.

Simplified Negotiations: MFNs can streamline early-stage fundraising by removing the complexities of negotiating a valuation cap.

However, MFNs have potential downsides:

Reduced Fundraising Flexibility: Offering increasingly favorable terms to later investors can deter future funding rounds and make negotiations more complex.

Potential for Disputes: Disagreements over MFN interpretations and amendments can strain founder-investor relationships and lead to legal disputes.

Strategic Considerations

MFN clauses can be valuable tools, but their inclusion should be carefully considered. Founders must weigh the benefits of investor protection against potential limitations on future fundraising flexibility.

Side Letters: Expanding the Scope of SAFEs

A side letter serves as an addendum to the main investment agreement, in this case, a SAFE. It allows investors and companies to customize certain terms or include additional provisions not covered in the standard SAFE template.

Pro Rata Rights: A Common Inclusion

The most common provision within a Y Combinator SAFE side letter is the inclusion of Pro Rata Rights. This grants SAFE investors the option, but not the obligation, to participate in future funding rounds to maintain their ownership percentage. It’s generally considered a balanced provision that benefits both founders and investors.

Beyond Pro Rata: Navigating Additional Terms

Occasionally, investors may attempt to introduce a range of additional rights and preferences into a side letter. Founders should always carefully review these terms with their legal counsel to fully comprehend their implications before agreeing.

Minimizing Side Letters: A Best Practice

While side letters offer customization, founders should strive to minimize their use whenever possible. Tracking and managing various side agreements can become unwieldy and create administrative burdens, especially as the company grows and undergoes multiple funding rounds.

The SAFE: Streamlining Early-Stage Funding

The SAFE revolutionized early-stage fundraising by providing a simpler, faster, and more founder-friendly alternative to traditional investment instruments. This guide aimed to demystify the key elements of SAFEs, empowering you to confidently navigate this stage of your entrepreneurial journey.

Remember: While this guide provides valuable information, it is not a substitute for professional legal advice. Consulting with an experienced attorney specializing in startup law is crucial to ensure you fully understand the implications of each SAFE term and secure the most favorable outcome for your specific situation.

Wishing you all the best in your entrepreneurial endeavors! Please don’t hesitate to reach out if you need assistance with SAFEs or any other legal matters related to your startup.

Download the SAFE templates from YCombinator

US companies

There are three versions of the post-money safe intended for use by US companies, plus an optional side letter.

- Safe: Valuation Cap, no Discount

- Safe: Discount, no Valuation Cap

- Safe: MFN, no Valuation Cap, no Discount

- Pro Rata Side Letter

- Safe User Guide

Non-US companies

There is one version of the post-money safe, Valuation Cap (no discount), intended for use by companies formed in Canada, Cayman and Singapore, plus an optional side letter for each country. Before using any of these international forms, you should consult with a lawyer licensed in the relevant country.